Is Wealthfront Cash the Savings Account You’ve Been Looking For

In todays financial landscape, finding a safe, reliable place for your money to grow is tougher than it seems. Sure, traditional savings accounts exist, but they often come with minuscule interest rates that barely outpace inflation. Enter Wealthfront Cash, a hybrid cash management account that promises more than just a holding place for your funds.

If youre someone looking for flexibility, competitive rates, and seamless integration with financial planning tools, this product might have your attention. But is it as good as it sounds? Lets dive deep into Wealthfront Cash and see what it brings to the table.

What is Wealthfront Cash?

Wealthfront Cash is a cash management account that combines the access and convenience of a checking account with the earning ability of a high-yield savings account. Unlike many traditional banking options, the product is not tied to any physical branches or outdated systems. Still, it is rather an online-first product that appeals to people who place a value on convenience and the latest in financial tools.

What sets Wealthfront Cash apart is its ability to serve as a flexible financial tool. You can deposit cash, pay bills, set up direct deposits, and even automate savings- all while generating a competitive interest rate. Technically, the account is not exactly a bank account; instead, it is managed through an alliance with several FDIC-insured banks. This assures that deposits are insured for up to $5 million, which is much greater than the standard limit provided by most banks.

The goal here is simple: give users a secure place for their cash thats more rewarding than a standard checking or savings account without the hoops of traditional banking.

Key Features of Wealthfront Cash

Wealthfront Cash is a flexible and user-friendly financial product with some key features that are helpful for modern banking needs:

High Interest Rates

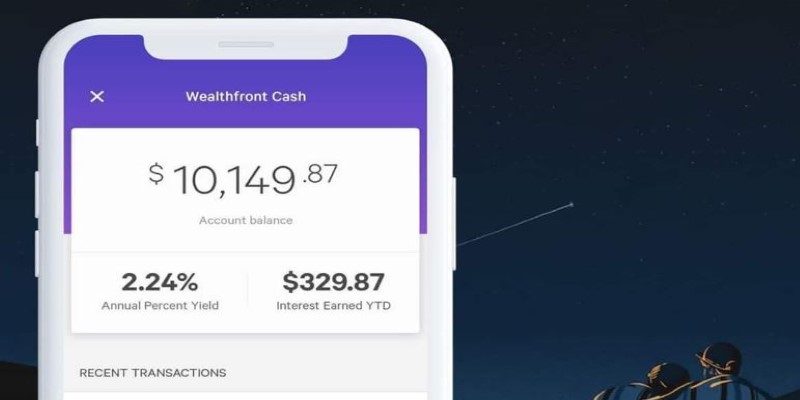

Wealthfront Cash provides competitive annual percentage yields (APYs), so your cash grows faster than in a traditional checking or savings account. The rates are typically above the national average, making it a great choice for people who want to earn more on idle money without locking that money into a long-term investment like a CD.

No Fees

Wealthfront Cash eliminates many common banking fees, including maintenance, overdraft, and ATM withdrawal fees. This no-cost approach ensures you retain more of your money without worrying about hidden charges. For individuals looking to simplify their finances, this account provides a transparent and cost-effective solution, making it especially appealing for those frustrated by traditional bank fees that often erode savings over time.

FDIC Insurance

Your Wealthfront Cash balance is insured for up to $5 million through partner banks, significantly exceeding the standard $250,000 coverage offered by most accounts. This enhanced FDIC insurance ensures greater financial security, making it a reliable place to store large cash reserves. Whether youre saving for major goals or managing business funds, this feature offers unparalleled peace of mind in safeguarding your assets.

Seamless Transfers

Wealthfront Cash simplifies money movement with instant transfers between Wealthfront accounts and quick ACH transfers to external banks. This ensures your funds are always accessible when needed. Whether youre transferring savings, paying bills, or funding investments, the process is fast and hassle-free. The convenience of seamless transfers makes this account well-suited for users who value efficiency and financial flexibility.

Budgeting and Automation

Integrated with Wealthfronts advanced financial planning tools, the Cash Account helps automate savings and track spending. Users can set goals, monitor progress, and allocate funds effortlessly. This automation fosters better financial habits, making it easier to prioritize long-term objectives while managing daily expenses.

Mobile-First Experience

Wealthfront Cash delivers a sleek, mobile-friendly experience, ensuring users can manage their finances anytime, anywhere. The intuitive app design simplifies navigation, allowing you to check balances, set goals, and transfer funds with ease. Perfect for digital-savvy users, the mobile-first approach ensures that banking is as accessible and convenient as possible, aligning with the needs of todays on-the-go lifestyles.

Pros and Cons of Wealthfront Cash

Every financial product has its strengths and weaknesses, and Wealthfront Cash is no exception. On the plus side, you get competitive interest rates, no fees, and robust automation features. The account is also highly secure, with its FDIC insurance spread across multiple partner banks.

However, there are limitations. Wealthfront Cash isnt ideal for people who rely on cash deposits since it doesnt support that feature. Similarly, while it offers bill pay and direct deposit capabilities, it may not replace a full-service checking account for everyone.

The account also requires a strong internet connection and comfort with managing money through an app or web portal. For older generations or those less familiar with digital banking, this could be a hurdle.

Is Wealthfront Cash Right for You?

The big question is whether Wealthfront Cash aligns with your financial needs. If youre looking for a no-fee, high-yield account that supports day-to-day banking and integrates with investment tools, its a strong contender. Its combination of features makes it especially appealing to young professionals and tech-savvy individuals who prioritize convenience and automation.

However, if you prefer in-person banking or need access to cash deposits, this might not be the best fit. Traditional banks or credit unions could offer more suitable solutions in those cases.

Ultimately, Wealthfront Cash is ideal for those who want their money to grow without the complications of maintaining multiple accounts. Its hybrid nature strikes a balance that many modern consumers find appealing.

Conclusion

Wealthfront Cash offers a modern, competitive alternative to traditional banking, combining high interest rates, no fees, and integration with Wealthfronts financial tools. Its ideal for those seeking a streamlined way to manage savings and daily finances in a digital-first world. While its features are impressive, it may not suit everyoneyour unique financial habits and goals should guide your choice. For many, however, it provides a compelling mix of convenience, growth potential, and innovation. As financial services evolve, Wealthfront Cash exemplifies how technology can enhance the way we save and manage money. Its a strong contender worth exploring.